The sixth annual Global Real Estate Sustainability Benchmark (GRESB) report released on September 2nd shows continued focus on sustainability by institutional real estate investors. The report is published in an effort to assess the sustainability performance of real estate portfolios and create a dynamic benchmark. In parallel with many growing trends, such as urbanization, resource constraints, and environmental impact, GRESB saw participation in the report balloon to 707 participants representing $2.1 trillion in property value. We’ve summarized 4 key takeaways from the report as they relate to what is driving sustainability initiatives.

Takeaway #1: Sustainability linked to higher returns

The report was quick to highlight that on a risk adjusted basis there is a significant link between portfolio sustainability indicators and Real Estate Investment Trust (REIT) stock market performance. Early studies show that outperformance on the GRESB benchmark equals higher returns for real estate investors. Within a GRESB score for an individual REIT, the Implementation & Measurement category of sustainability initiatives is a powerful driver of outperformance given the tangible gains from efficient operations.

Takeaway #2: Investors and regulators are demanding transparency and high quality data

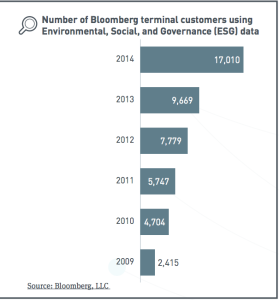

Between investors and regulators, the demand for transparency and high quality data regarding Environmental, Social, and Governance (ESG) data is growing. The number of countries and municipalities requiring asset ratings increased from last year as did corporate participation in the Global Reporting Initiative and the Carbon Disclosure Project. The chart below shows increased use of Bloomberg terminal customers (investors) using ESG data:

Takeaway #3: Sustainability has permeated into all aspects and levels of real estate

In 2015 93% of report participants incorporated sustainability objectives into their overall business strategy, up from 81% in 2014. 94% have a senior decision maker dedicated to sustainability. The chart below shows that a wide variety of roles in real estate now have sustainability-related targets in place:

Takeaway #4: Reduced energy consumption remains one of the most cost-effective opportunities to lower operating expenses and to mitigate environmental impacts

Given the cost-effectiveness, reduction of energy consumption has become a bedrock of ESG management in the built environment. 90% of report participants monitor energy consumption with 65% of those monitoring consumption using meters for monitoring and 78% checking their bills as well. Certain sectors of the real estate industry are in a better position to capture energy data and reduce energy consumption (office buildings are in the best position). 88% of office building report participants collect energy data and 78% perform some form of variance reporting. Office buildings ability to reduce energy is reflected below in the 3% drop between 2013-14.

Kilroy Realty–an organization we are proud to reference as a long standing user of Gridium’s energy data analytics–was named by GRESB for the second year in a row as the North American leader in sustainability. “A commitment to sustainability is the foundation of everything we do at KRC. We are thrilled to again be named the top real estate landlord in North America by GRESB, as well as Regional Sector Leader. It once again demonstrates how committed every member of the KRC team is to sustainability,” said Sara Neff, Vice President of Sustainability at Kilroy.

Congratulations to Sara and the entire Kilroy Realty team!

Nice post, Millen. It is very encouraging to see such increased traction in ESG-related metrics. Gives one hope, does it not?

Thanks, Conor and yes it does!